India’s Semiconductor Journey: A New Frontier

In October, a notable achievement unfolded in Gujarat, India, as a small electronics manufacturer made its debut by shipping chip modules to a client in California. Kaynes Semicon, alongside its technological allies from Japan and Malaysia, produced these chips in a factory developed with support from Indian Prime Minister Narendra Modi’s ambitious $10 billion semiconductor initiative, launched in 2021. Modi aims to establish India as a viable manufacturing alternative for global companies seeking to reduce their reliance on China, though progress has been modest.

A Glimpse of Progress

Currently, a commercial foundry dedicated to older chip technologies is under construction in Gujarat, symbolizing a step forward. This $11 billion initiative, in collaboration with a Taiwanese chip producer, has also attracted Intel, the U.S. chip giant, as a prospective client. Given the soaring demand for chips worldwide, India’s involvement in chip production could significantly enhance its role in global supply chains. However, experts warn that attracting more foreign investment and advancing in cutting-edge technology remains a significant challenge for the country.

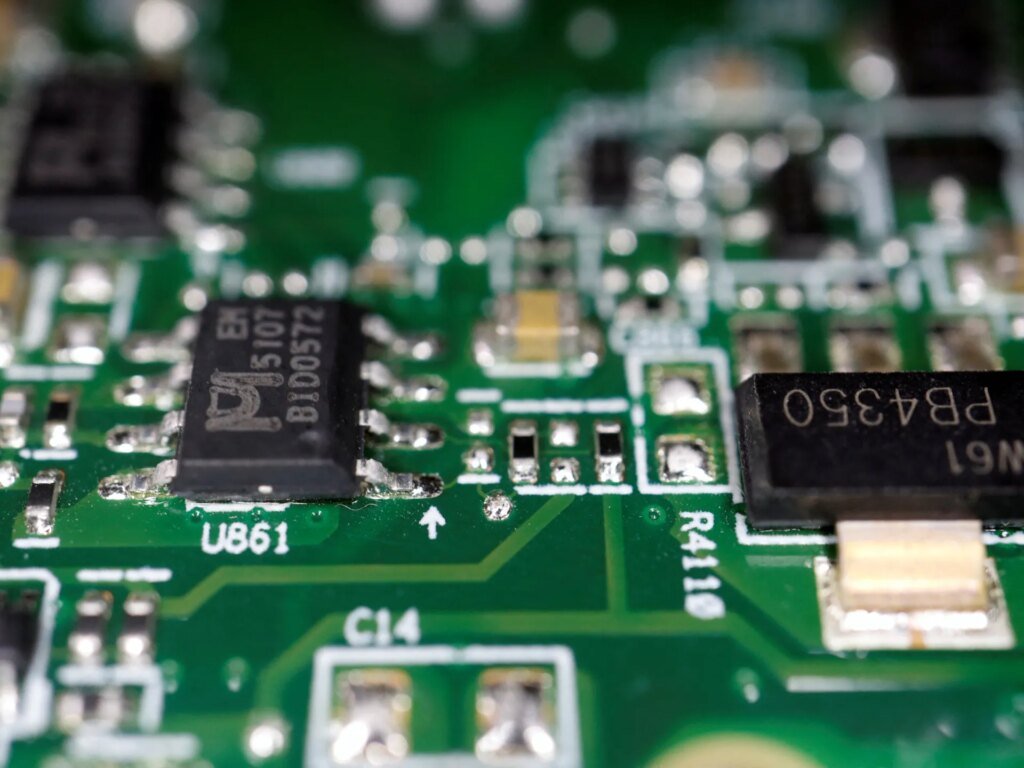

Understanding the Semiconductor Landscape

Semiconductors involve the intricate processes of design, fabrication in foundries, and subsequent assembly for commercial use. The U.S. is a leader in chip design, while Taiwan excels in fabrication, and China holds a growing advantage in packaging. The collaborative foundry in Gujarat, the result of a partnership between India’s Tata Group and Taiwan’s Powerchip Semiconductor Manufacturing Corporation (PSMC), is pivotal for India’s semiconductor ambitions.

Key Partnerships and Developments

On December 8, Tata Electronics expanded its collaboration with Intel, exploring the manufacturing and packaging of its products at Tata’s upcoming facilities. This collaboration is aimed at addressing the rising domestic demand for semiconductors.

The Modi government has approved a substantial 50% subsidy for Tata to aid in the establishment of this foundry, which could become operational by December 2026. This development marks a crucial milestone for India, which has faced numerous challenges in building a commercial fabrication facility in the past.

The Shift Toward Mature Chips

The forthcoming foundry will focus on manufacturing chips with sizes ranging from 28 nanometers to 110 nanometers, known as mature chips, which are simpler to produce than the more advanced 7nm or 3nm counterparts. Mature chips power various consumer and industrial electronics, while smaller chips cater to the high-demand sectors of AI and high-performance computing. Taiwan leads in the production of these mature chips, with China rapidly following suit. However, Taiwan’s TSMC maintains a stronghold on cutting-edge technologies.

Challenges and Future Outlook

According to Stephen Ezell, a vice president at the Information Technology and Innovation Foundation, India has a rich history in chip design but faces obstacles in transforming that expertise into manufacturing capability. In recent years, significant progress has been noted, driven by increased political and private sector support.

Investment Landscape

More than half of the Modi government’s semiconductor budget is allocated for the Tata-PSMC venture, with other investments directed toward several assembly, testing, and packaging projects. These initiatives include ventures by Micron Technology in Gujarat and additional projects by Tata in Assam, with total investments surpassing $6 billion.

A shift toward assembly, testing, and packaging units represents a less complex and lower-risk entry point into the semiconductor market. These units typically require smaller investments and leverage widely available technology.

Addressing Domestic Demands

The focus of India’s semiconductor projects on legacy chips, while significant, highlights a growing necessity to manage domestic demand, projected to double from $50 billion today to $100 billion by 2030. India’s drive towards this sector is crucial, especially as global semiconductor markets expand dramatically.

India’s imports of semiconductor components have surged in recent years, with expectations for continued growth. In light of the increasing demand, there are calls for greater domestic production capabilities, particularly for chips that were once viewed as fundamental.

Looking Ahead

The Indian government’s semiconductor push, while substantial, still pales in comparison to the massive investments made by countries like China and the United States. Continued governmental support, coupled with a robust strategy to attract foreign partnerships, will be essential for India to remain competitive in the semiconductor landscape.

As India progresses into the semiconductor industry, the implications for the local economy and technological prowess could be enormous. The future holds great potential, but it’s paramount that India continuously adapts to the fast-evolving global chip market if it aims to play a significant role on the world stage.

Conclusion

India’s venture into semiconductor manufacturing marks an exciting chapter driven by ambition, international partnerships, and a commitment to meeting burgeoning domestic needs. The journey is just beginning, and for India to excel, it will need to embrace innovation and collaboration with global leaders in this critical sector.

Key Takeaways

- India is now manufacturing semiconductors, targeting both local and global markets.

- The country’s focus is on developing mature chips, addressing a significant portion of the global demand.

- Partnerships with global tech giants like Intel and collaboration with Taiwanese firms are pivotal for success.

- India’s future in the semiconductor space will depend on continued investment and modernized policies to attract foreign partnerships.